- Location

- Bountiful, land of rocks

Yahoo delivering a NYTimes article

news.yahoo.com

news.yahoo.com

Tue, August 29, 2023 at 1:05 PM MDT·10 min read

1.2k

Steam rises from the Roosevelt Hot Springs, near the FORGE and Fervo geothermal sites outside of Milford, Utah, on July 31, 2023. (Brandon Thibodeaux/The New York Times)

BEAVER COUNTY, Utah — In a sagebrush valley full of wind turbines and solar panels in western Utah, Tim Latimer gazed up at a very different device he believes could be just as powerful for fighting climate change — maybe even more.

It was a drilling rig, of all things, transplanted from the oil fields of North Dakota. But the softly whirring rig wasn’t searching for fossil fuels. It was drilling for heat.

Latimer’s company, Fervo Energy, is part of an ambitious effort to unlock vast amounts of geothermal energy from Earth’s hot interior, a source of renewable power that could help displace fossil fuels that are dangerously warming the planet.

Sign up for The Morning newsletter from the New York Times

“There’s a virtually unlimited resource down there if we can get at it,” Latimer said. “Geothermal doesn’t use much land, it doesn’t produce emissions, it can complement wind and solar power. Everyone who looks into it gets obsessed with it.”

Traditional geothermal plants, which have existed for decades, work by tapping natural hot water reservoirs underground to power turbines that can generate electricity 24 hours a day. Few sites have the right conditions for this, however, so geothermal only produces 0.4% of America’s electricity.

But hot, dry rocks lie below the surface everywhere on the planet. And by using advanced drilling techniques developed by the oil and gas industry, some experts think it’s possible to tap that larger store of heat and create geothermal energy almost anywhere. The potential is enormous: The Energy Department estimates there’s enough energy in those rocks to power the entire country five times over and has launched a major push to develop technologies to harvest that heat.

Dozens of geothermal companies have emerged with ideas.

Fervo is using fracking techniques — similar to those used for oil and gas — to crack open dry, hot rock and inject water into the fractures, creating artificial geothermal reservoirs. Eavor, a Canadian startup, is building large underground radiators with drilling methods pioneered in Alberta’s oil sands. Others dream of using plasma or energy waves to drill even deeper and tap “superhot” temperatures that could cleanly power thousands of coal-fired power plants by substituting steam for coal.

Still, obstacles to geothermal expansion loom. Investors are wary of the cost and risks of novel geothermal projects. Some worry about water use or earthquakes from drilling. Permitting is difficult. And geothermal gets less federal support than other technologies.

Still, the growing interest in geothermal is driven by the fact that the United States has gotten extraordinarily good at drilling since the 2000s. Innovations like horizontal drilling and magnetic sensing have pushed oil and gas production to record highs, much to the dismay of environmentalists. But these innovations can be adapted for geothermal, where drilling can make up half the cost of projects.

“Everyone knows about cost declines for wind and solar,” said Cindy Taff, who worked at Shell for 36 years before joining Sage Geosystems, a geothermal startup in Houston. “But we also saw steep cost declines for oil and gas drilling during the shale revolution. If we can bring that to geothermal, the growth could be huge.”

States like California are increasingly desperate for clean energy sources that can run at all hours. While wind and solar power are growing fast, they rely on fossil fuels like natural gas for backup when the sun sets and wind fades. Finding a replacement for gas is an acute climate challenge, and geothermal is one of the few plausible options.

“Geothermal has historically been overlooked,” Sen. Lisa Murkowski, R-Alaska, said at a hearing. But with innovation, she added, “the potential is out there, I think, that’s pretty extraordinary.”

Fracking for Clean Energy

Near the town of Milford, Utah, sits the Blundell geothermal plant, surrounded by boiling mud pits, hissing steam vents and the skeletal ruins of a hot springs resort. Built in 1984, the 38-megawatt plant produces enough electricity for about 31,000 homes.

The Blundell plant relies on ancient volcanism and quirks of geology: Just below the surface are hot, naturally porous rocks that allow groundwater to percolate and heat up enough to create steam for generating electricity. But such conditions are rare. In much of the region, the underground hot rock is hard granite, and water can’t flow easily.

Three miles east, two teams are trying to tap that hot granite. One is Utah FORGE, a $220 million research effort funded by the Energy Department. The other is Fervo, a Houston-based startup.

Both use similar methods: First, drill two wells shaped like giant L’s, extending thousands of feet down into hot granite before curving and extending thousands of feet horizontally. Then, use fracking, which involves controlled explosives and high-pressure fluids, to create a series of cracks between the two wells. Finally, inject water into one well, where it will hopefully migrate through the cracks, heat up past 300 degrees Fahrenheit and come out the other well.

This is “enhanced geothermal,” and people have struggled with the engineering difficulties since the 1970s.

But in July, FORGE announced it had successfully sent water between two wells. Two weeks later, Fervo announced its own breakthrough: A 30-day test in Nevada found the process could produce enough heat for electricity. Fervo is now drilling wells for its first 400-megawatt commercial power plant in Utah, next to the FORGE site.

“Those are major accomplishments, in a time frame faster than we expected,” said Lauren Boyd, head of the Energy Department’s Geothermal Technologies Office, which estimates that geothermal could supply 12% of America’s electricity by 2050 if technology improves.

Latimer seemed less surprised. Before founding Fervo in 2017, he worked as a drilling engineer for BHP, an oil and gas firm. There, he became convinced that previous attempts at enhanced geothermal failed because they hadn’t taken advantage of oil and gas innovations like horizontal drilling or fiber-optic sensors.

Fervo didn’t invent many of the tools it uses. In Utah, drilling is conducted by Helmerich & Payne, a major oil and gas contractor that developed a high-tech rig with software and sensors that allow operators to precisely steer drill bits underground. Sixty percent of Fervo’s employees came from oil and gas.

“If we had to invent this stuff ourselves it would have taken years or decades,” Latimer said. “Our big insight was that people in geothermal simply weren’t talking enough to people in oil and gas.”

The hard part now is making enhanced geothermal affordable. The Energy Department wants costs to plummet to $45 per megawatt-hour for widespread deployment. Fervo’s costs are “much higher,” Latimer said, though he thinks repeated drilling can lower them.

Research at FORGE could help. Drilling deeper and hotter can make projects more cost-effective, since more heat means more energy. But existing oil and gas equipment wasn’t designed for temperatures above 350 degrees, so FORGE is testing new tools in hotter rock.

“No one else is willing to take the risks we can take,” said Joseph Moore, a University of Utah geologist who leads FORGE.

Enhanced geothermal faces other challenges, Moore cautioned. Underground geology is complex, and it’s tricky to create fractures that maintain heat and don’t lose too much water over time. Drillers must avoid triggering earthquakes, a problem that plagued geothermal projects in South Korea and Switzerland. FORGE closely monitors its Utah site for seismic activity and has found nothing worrisome.

Permitting is tough. While enhanced geothermal could, in theory, work anywhere, the best resources are on federal land, where regulatory reviews take years and it’s often easier to win permission for oil and gas drilling because of exemptions won by fossil fuel companies.

Still, interest is rising. California is struggling with electricity shortfalls and recently had to extend the life of three old, polluting gas plants. Regulators have ordered utilities to add 1,000 megawatts of electricity from clean sources that can run at all hours to backstop fluctuating wind and solar supplies. One electricity provider, Clean Power Alliance, agreed to buy 33 megawatts from Fervo’s Utah plant.

“If we can find it, we have a pretty big appetite for geothermal,” said Ted Bardacke, Clean Power Alliance’s CEO. “We’re adding more solar every year for daytime and have a huge build-out of batteries to shift power to the evening. But what do we do at night? That’s where geothermal can really help out.”

Underground Radiators and Superhot Rocks

Fervo faces fierce competition for the future of geothermal.

One alternative is a “closed loop” system, which involves drilling sealed pipes into hot, dry rocks and then circulating fluid through the pipes, creating a giant radiator. This avoids the unpredictability of water flowing through underground rock and doesn’t involve fracking, which is banned in some areas. The downside: more complicated drilling.

Eavor, a Calgary-based company, has already tested a closed-loop system in Alberta and is now building its first 65-megawatt plant in Germany.

“If geothermal is ever going to scale, it has to be a repeatable process you can do over and over,” said John Redfern, Eavor’s CEO. “We think we’ve got the best way to do that.”

In Texas, Sage Geosystems is pursuing fracked wells that act as batteries. When there’s surplus electricity on the grid, water gets pumped into the well. In times of need, pressure and heat in the fractures pushes water back up, delivering energy.

The most audacious vision for geothermal is to drill 6 miles or more underground where temperatures exceed 750 degrees Fahrenheit. At that point, water goes supercritical and can hold five to 10 times as much energy as normal steam. If it works, experts say, “superhot” geothermal could provide cheap, abundant clean energy anywhere.

“The ultimate goal should be to get to the superhot stuff,” said Bruce Hill of the Clean Air Task Force, an environmental group.

But going that deep requires futuristic tools. GA Drilling, a Slovakian company, is developing plasma torches for drilling at high temperatures. Quaise, a Massachusetts-based startup, wants to use millimeter waves — high-frequency microwaves — to pulverize rock and reach depths of up to 12 miles.

“There are huge engineering challenges,” said Carlos Araque, Quaise’s CEO.

“But,” he added, “imagine if you could drill down next to a coal plant and get steam that’s hot enough to power that plant’s turbines. Replacing coal at thousands of coal plants around the world. That’s the level of geothermal we’re trying to unlock.”

Oil Interest

The U.S. government plays a leading role in nurturing risky new energy technologies. But lawmakers often overlook geothermal. The recent infrastructure bill provided $9.5 billion for clean hydrogen but just $84 million for advanced geothermal.

“It’s been hard for geothermal to fight its way into the conversation,” said Jamie Beard, founder of Project InnerSpace, a Texas-based nonprofit that promotes geothermal.

Beard has spent years trying to get oil and gas companies excited about geothermal. That’s slowly happening: Devon Energy invested $10 million into Fervo, while BP and Chevron are backing Eavor. Nabors, a drilling-service provider, has invested in GA Drilling, Quaise and Sage.

In Oklahoma, a consortium of oil and gas firms led by Baker Hughes recently launched an effort to explore converting abandoned wells into geothermal plants.

“Historically, the upfront costs and risks of geothermal have been challenging,” said Ajit Menon, vice president for geothermal at Baker Hughes. “But we think it’s got a huge role to play. And we have workers with the right skills, the right technology. You can see why it makes sense for us.”

c.2023 The New York Times Company

View comments (1.2k)

There’s a Vast Source of Clean Energy Beneath Our Feet. And a Race to Tap It.

BEAVER COUNTY, Utah — In a sagebrush valley full of wind turbines and solar panels in western Utah, Tim Latimer gazed up at a very different device he believes could be just as powerful for fighting climate change — maybe even more. It was a drilling rig, of all things, transplanted from the oil...

There’s a Vast Source of Clean Energy Beneath Our Feet. And a Race to Tap It.

Brad PlumerTue, August 29, 2023 at 1:05 PM MDT·10 min read

1.2k

Steam rises from the Roosevelt Hot Springs, near the FORGE and Fervo geothermal sites outside of Milford, Utah, on July 31, 2023. (Brandon Thibodeaux/The New York Times)

BEAVER COUNTY, Utah — In a sagebrush valley full of wind turbines and solar panels in western Utah, Tim Latimer gazed up at a very different device he believes could be just as powerful for fighting climate change — maybe even more.

It was a drilling rig, of all things, transplanted from the oil fields of North Dakota. But the softly whirring rig wasn’t searching for fossil fuels. It was drilling for heat.

Latimer’s company, Fervo Energy, is part of an ambitious effort to unlock vast amounts of geothermal energy from Earth’s hot interior, a source of renewable power that could help displace fossil fuels that are dangerously warming the planet.

Sign up for The Morning newsletter from the New York Times

“There’s a virtually unlimited resource down there if we can get at it,” Latimer said. “Geothermal doesn’t use much land, it doesn’t produce emissions, it can complement wind and solar power. Everyone who looks into it gets obsessed with it.”

Traditional geothermal plants, which have existed for decades, work by tapping natural hot water reservoirs underground to power turbines that can generate electricity 24 hours a day. Few sites have the right conditions for this, however, so geothermal only produces 0.4% of America’s electricity.

But hot, dry rocks lie below the surface everywhere on the planet. And by using advanced drilling techniques developed by the oil and gas industry, some experts think it’s possible to tap that larger store of heat and create geothermal energy almost anywhere. The potential is enormous: The Energy Department estimates there’s enough energy in those rocks to power the entire country five times over and has launched a major push to develop technologies to harvest that heat.

Dozens of geothermal companies have emerged with ideas.

Fervo is using fracking techniques — similar to those used for oil and gas — to crack open dry, hot rock and inject water into the fractures, creating artificial geothermal reservoirs. Eavor, a Canadian startup, is building large underground radiators with drilling methods pioneered in Alberta’s oil sands. Others dream of using plasma or energy waves to drill even deeper and tap “superhot” temperatures that could cleanly power thousands of coal-fired power plants by substituting steam for coal.

Still, obstacles to geothermal expansion loom. Investors are wary of the cost and risks of novel geothermal projects. Some worry about water use or earthquakes from drilling. Permitting is difficult. And geothermal gets less federal support than other technologies.

Still, the growing interest in geothermal is driven by the fact that the United States has gotten extraordinarily good at drilling since the 2000s. Innovations like horizontal drilling and magnetic sensing have pushed oil and gas production to record highs, much to the dismay of environmentalists. But these innovations can be adapted for geothermal, where drilling can make up half the cost of projects.

“Everyone knows about cost declines for wind and solar,” said Cindy Taff, who worked at Shell for 36 years before joining Sage Geosystems, a geothermal startup in Houston. “But we also saw steep cost declines for oil and gas drilling during the shale revolution. If we can bring that to geothermal, the growth could be huge.”

States like California are increasingly desperate for clean energy sources that can run at all hours. While wind and solar power are growing fast, they rely on fossil fuels like natural gas for backup when the sun sets and wind fades. Finding a replacement for gas is an acute climate challenge, and geothermal is one of the few plausible options.

“Geothermal has historically been overlooked,” Sen. Lisa Murkowski, R-Alaska, said at a hearing. But with innovation, she added, “the potential is out there, I think, that’s pretty extraordinary.”

Fracking for Clean Energy

Near the town of Milford, Utah, sits the Blundell geothermal plant, surrounded by boiling mud pits, hissing steam vents and the skeletal ruins of a hot springs resort. Built in 1984, the 38-megawatt plant produces enough electricity for about 31,000 homes.

The Blundell plant relies on ancient volcanism and quirks of geology: Just below the surface are hot, naturally porous rocks that allow groundwater to percolate and heat up enough to create steam for generating electricity. But such conditions are rare. In much of the region, the underground hot rock is hard granite, and water can’t flow easily.

Three miles east, two teams are trying to tap that hot granite. One is Utah FORGE, a $220 million research effort funded by the Energy Department. The other is Fervo, a Houston-based startup.

Both use similar methods: First, drill two wells shaped like giant L’s, extending thousands of feet down into hot granite before curving and extending thousands of feet horizontally. Then, use fracking, which involves controlled explosives and high-pressure fluids, to create a series of cracks between the two wells. Finally, inject water into one well, where it will hopefully migrate through the cracks, heat up past 300 degrees Fahrenheit and come out the other well.

This is “enhanced geothermal,” and people have struggled with the engineering difficulties since the 1970s.

But in July, FORGE announced it had successfully sent water between two wells. Two weeks later, Fervo announced its own breakthrough: A 30-day test in Nevada found the process could produce enough heat for electricity. Fervo is now drilling wells for its first 400-megawatt commercial power plant in Utah, next to the FORGE site.

“Those are major accomplishments, in a time frame faster than we expected,” said Lauren Boyd, head of the Energy Department’s Geothermal Technologies Office, which estimates that geothermal could supply 12% of America’s electricity by 2050 if technology improves.

Latimer seemed less surprised. Before founding Fervo in 2017, he worked as a drilling engineer for BHP, an oil and gas firm. There, he became convinced that previous attempts at enhanced geothermal failed because they hadn’t taken advantage of oil and gas innovations like horizontal drilling or fiber-optic sensors.

Fervo didn’t invent many of the tools it uses. In Utah, drilling is conducted by Helmerich & Payne, a major oil and gas contractor that developed a high-tech rig with software and sensors that allow operators to precisely steer drill bits underground. Sixty percent of Fervo’s employees came from oil and gas.

“If we had to invent this stuff ourselves it would have taken years or decades,” Latimer said. “Our big insight was that people in geothermal simply weren’t talking enough to people in oil and gas.”

The hard part now is making enhanced geothermal affordable. The Energy Department wants costs to plummet to $45 per megawatt-hour for widespread deployment. Fervo’s costs are “much higher,” Latimer said, though he thinks repeated drilling can lower them.

Research at FORGE could help. Drilling deeper and hotter can make projects more cost-effective, since more heat means more energy. But existing oil and gas equipment wasn’t designed for temperatures above 350 degrees, so FORGE is testing new tools in hotter rock.

“No one else is willing to take the risks we can take,” said Joseph Moore, a University of Utah geologist who leads FORGE.

Enhanced geothermal faces other challenges, Moore cautioned. Underground geology is complex, and it’s tricky to create fractures that maintain heat and don’t lose too much water over time. Drillers must avoid triggering earthquakes, a problem that plagued geothermal projects in South Korea and Switzerland. FORGE closely monitors its Utah site for seismic activity and has found nothing worrisome.

Permitting is tough. While enhanced geothermal could, in theory, work anywhere, the best resources are on federal land, where regulatory reviews take years and it’s often easier to win permission for oil and gas drilling because of exemptions won by fossil fuel companies.

Still, interest is rising. California is struggling with electricity shortfalls and recently had to extend the life of three old, polluting gas plants. Regulators have ordered utilities to add 1,000 megawatts of electricity from clean sources that can run at all hours to backstop fluctuating wind and solar supplies. One electricity provider, Clean Power Alliance, agreed to buy 33 megawatts from Fervo’s Utah plant.

“If we can find it, we have a pretty big appetite for geothermal,” said Ted Bardacke, Clean Power Alliance’s CEO. “We’re adding more solar every year for daytime and have a huge build-out of batteries to shift power to the evening. But what do we do at night? That’s where geothermal can really help out.”

Underground Radiators and Superhot Rocks

Fervo faces fierce competition for the future of geothermal.

One alternative is a “closed loop” system, which involves drilling sealed pipes into hot, dry rocks and then circulating fluid through the pipes, creating a giant radiator. This avoids the unpredictability of water flowing through underground rock and doesn’t involve fracking, which is banned in some areas. The downside: more complicated drilling.

Eavor, a Calgary-based company, has already tested a closed-loop system in Alberta and is now building its first 65-megawatt plant in Germany.

“If geothermal is ever going to scale, it has to be a repeatable process you can do over and over,” said John Redfern, Eavor’s CEO. “We think we’ve got the best way to do that.”

In Texas, Sage Geosystems is pursuing fracked wells that act as batteries. When there’s surplus electricity on the grid, water gets pumped into the well. In times of need, pressure and heat in the fractures pushes water back up, delivering energy.

The most audacious vision for geothermal is to drill 6 miles or more underground where temperatures exceed 750 degrees Fahrenheit. At that point, water goes supercritical and can hold five to 10 times as much energy as normal steam. If it works, experts say, “superhot” geothermal could provide cheap, abundant clean energy anywhere.

“The ultimate goal should be to get to the superhot stuff,” said Bruce Hill of the Clean Air Task Force, an environmental group.

But going that deep requires futuristic tools. GA Drilling, a Slovakian company, is developing plasma torches for drilling at high temperatures. Quaise, a Massachusetts-based startup, wants to use millimeter waves — high-frequency microwaves — to pulverize rock and reach depths of up to 12 miles.

“There are huge engineering challenges,” said Carlos Araque, Quaise’s CEO.

“But,” he added, “imagine if you could drill down next to a coal plant and get steam that’s hot enough to power that plant’s turbines. Replacing coal at thousands of coal plants around the world. That’s the level of geothermal we’re trying to unlock.”

Oil Interest

The U.S. government plays a leading role in nurturing risky new energy technologies. But lawmakers often overlook geothermal. The recent infrastructure bill provided $9.5 billion for clean hydrogen but just $84 million for advanced geothermal.

“It’s been hard for geothermal to fight its way into the conversation,” said Jamie Beard, founder of Project InnerSpace, a Texas-based nonprofit that promotes geothermal.

Beard has spent years trying to get oil and gas companies excited about geothermal. That’s slowly happening: Devon Energy invested $10 million into Fervo, while BP and Chevron are backing Eavor. Nabors, a drilling-service provider, has invested in GA Drilling, Quaise and Sage.

In Oklahoma, a consortium of oil and gas firms led by Baker Hughes recently launched an effort to explore converting abandoned wells into geothermal plants.

“Historically, the upfront costs and risks of geothermal have been challenging,” said Ajit Menon, vice president for geothermal at Baker Hughes. “But we think it’s got a huge role to play. And we have workers with the right skills, the right technology. You can see why it makes sense for us.”

c.2023 The New York Times Company

View comments (1.2k)

Read next

Canadian Engineers Make "Revolutionary" Hydrogen Breakthrough

Editor OilPrice.com

Wed, August 30, 2023 at 5:00 PM MDT·21 min read

76

Already one of the world’s top ten producers of hydrogen, Canada is at the forefront of the global effort to develop a sustainable hydrogen economy, and a recent breakthrough may just bring it closer to becoming one of the most important energy transition hubs on the planet.

Canada is home to more than 100 hydrogen and fuel cell tech companies, and one of them has flipped the switch on a unique new hydrogen reactor in Hamilton, Ontario, Canada.

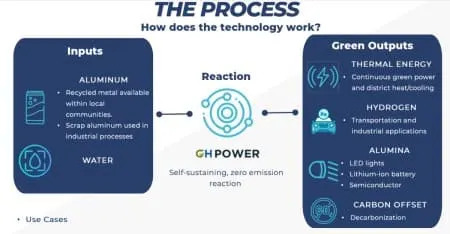

Canadian company GH Power and its team of world-class engineers led by CEO Dave White are bringing the world green hydrogen, high-quality heat and green alumina that can be fed into the grid using proprietary reactor technology that relies on only two inputs, creating zero waste and zero carbon emissions.

The reactor is said to be the very first of its kind to operate continuously, extracting baseload energy and hydrogen from the rapid oxidation of metal in water.

The Hydrogen system is designed to be modular and scalable and to enable local microgrids to supply baseload, reliable green energy solutions anywhere, anytime--even in the most remote areas of the world.

The reaction is exothermic and self-sustaining, safe, quiet and deployable within the last mile of the energy user.

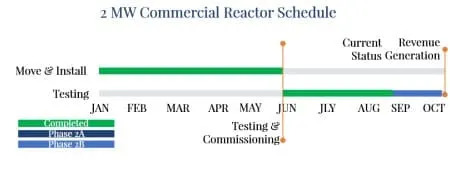

For Canada’s ambitions of becoming a major hydrogen superpower, the reactor, which began final Phase II testing on June 23rd, with commercial operations set to begin by Q4 2023, represents an impressive step forward in the high-stakes, low-carbon hydrogen game.

For GH Power, seven years of quiet and painstaking research and testing has turned the company into an award-winning innovator that hopes to reward future investors with four potential revenue streams.

PARTNERING FOR A CLEAN, SECURE FUTURE

In August 2022, just five months after Russia launched its war on Ukraine and the weaponization of energy rose to the forefront, Canada took decisive steps to accelerate the global clean energy transition, signing a Joint Declaration of Intent with Germany to collaborate on the export of clean Canadian hydrogen to Europe’s economic powerhouse.

The deal means a commitment to enable investment in hydrogen projects through policy harmonization; support for the development of secure hydrogen supply chains; the creation of a Transatlantic Canada-Germany supply corridor; and the export of clean Canadian hydrogen by 2025.

GH Power’s unique hydrogen reactor has been a focal point of this alliance, and its technology has been awarded $ 2.2 million in federal funding from the National Research Council of Canada as part of the Transatlantic commitment with Germany. The award is intended to support further research of the optimum fuel mixture for its reactor and the ultimate refinement of its high-purity alumina.

This award-winning technology is the result of seven years of painstaking research by world-class scientists and engineers led by GH Power CEO Dave White, a veteran engineer in the power generation space. Combined, the GH Power team has over a century of power generation experience, designing, building and operating power plants, refineries and other energy infrastructure.

Chief Engineer Ken Steward has been designing and managing thermal power plants and petrochemical processes for over four decades across numerous different power plants in North America. COO Gary Grahn brings to the table 25 years of international energy experience, including in oil, gas, minerals, metals and utilities, and CFO Anand Patel contributes a decade of real asset capital markets experience, with over $4 billion in completed transactions, including for renewable energy giant Brookfield Asset Management. Finally, project development director Mike Miller offers more than 35 years of experience in infrastructure, private equity, and development for top companies along the energy supply chain, such as giant NextEra Energy.

“Unlocking the potential of hydrogen is an essential part of our government’s plan for a sustainable economic future — not just for the domestic opportunities for emissions reductions but also for its potential as an export opportunity: to provide clean energy to countries around the globe,” the Honorable Jonathan Wilkinson, Minister of Natural Resources, said following the signing of the alliance deal with Germany.

“Green hydrogen is an important key for a climate-neutral economy. We must resolutely pursue climate change mitigation in order to secure our prosperity and freedom. This is more important and urgent than ever at this time,” German Vice-Chancellor Robert Habeck said. “The Hydrogen Alliance between Canada and Germany is a significant milestone as we accelerate the international market rollout of green hydrogen and clear the way for new transatlantic cooperation. Specifically, we aim to build up a transatlantic supply chain for green hydrogen. The first shipments from Canada to Germany are to begin as early as 2025.”

In partnership with Carleton University, Germany’s ParteQ, particle separation equipment supplier, the National Research Council of Canada, and RWTH Aachen University, the first-of-its-kind reactor is now fully in the global, low-carbon hydrogen spotlight.

INSIDE THE FIRST-OF-ITS-KIND REACTOR

The hydrogen produced by the modular version of GH Power’s 2MW reactor is pure and clean, with zero emissions, zero carbon and zero waste, using only 2 inputs (recycled aluminum and water). Only a small amount of energy is required to start the reactor, after which it is a self-sustaining operation that is a net generator of power to the grid.

GH Power’s Zero-Carbon Hydrogen

Zero-carbon hydrogen is arguably what could make or break the world’s net-zero emissions goals. It’s the closest answer we have to combat the disastrous impacts of climate change. The Hydrogen Council estimates that hydrogen will represent 18% of all energy delivered to end users by 2050, avoiding 6 gigatonnes of carbon emissions annually and turning around $2.5 trillion in annual sales (not to mention creating 30 million jobs globally).

For now, the majority of hydrogen in North America is produced by natural gas reforming in large central plants—an important step in the energy transition. The end goal, however, is to produce hydrogen without creating carbon emissions. Now, scientists are attempting to advance a process called “electrolysis” to create pure, clean hydrogen by splitting water into pure hydrogen and oxygen using high-temperature electrolyzers.

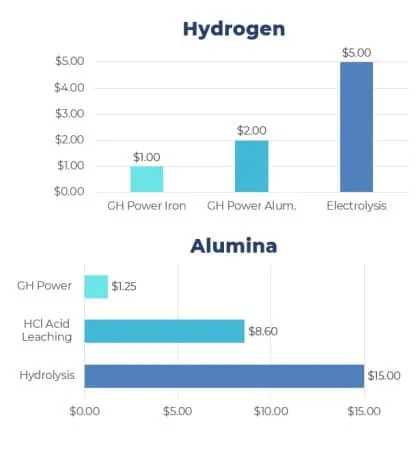

According to the U.S. Department of Energy (DoE), the cost of producing hydrogen from renewable energy is around $5 per kilogram, or approximately 3X higher than producing hydrogen from natural gas. The DoE hopes the billions of dollars it’s pouring into R&D now will reduce hydrogen production costs by 80% (to an ideal of $1 per kilogram) within a decade.

By the company’s estimates, GH Power’s reactor is already 60% cheaper than producing hydrogen than DoE estimates, and it is a net producer of electricity to the grid. Its green alumina by-product production costs are also 85% cheaper than the most commonly used processes such as hydrochloric acid leaching and hydrolysis for alumina production.

The company has also had successful tests using scrap steel (iron) as another metal fuel providing a scalable hydrogen generation solution with a much lower costs basis at under a $1/kg hydrogen. Scrap steel (iron) is a widely available metal fuel that GH Power is testing.

Zero-Carbon Alumina—A World First

GH Power’s reactor produces green high-purity alumina (HPA)—a valuable specialty product used by several high-growth technology markets, including semiconductors, LED products, lithium-ion batteries, Smartphones, a multitude of other electronic devices, and industrial ceramics.

LED is a high-growth industry because it is critical to improving energy efficiency. Lithium-ion batteries are likewise experiencing soaring growth amid an energy transition driven heavily by the mainstream adoption of electric vehicles. Demand for Smartphones and other electric devices is also continuously rising. All of this suggests significant growth in demand for HPA.

Today’s supply is determined by production processes that are highly capital-intensive. Projects face financing issues as a result of high energy prices for production, leading to tight supply. GH Power looks to be very well position to compete in this market sector with their low-cost green alumina products.

Exothermic Heat & Carbon Credits

This is a new technology based on a circular economy. Not only does it use recyclable inputs, but the exothermic heat from the reaction can also be used to generate high quality steam and hot water for industrial applications.

And once scaled up, GH Power’s 27-megawatt plant will run off the combustion of hydrogen gas and capturing the energy from the reaction’s exothermic heat. This combined cycle (CHP) approach can be added to an existing power generation asset which could significantly reduce CO2 emissions or it can be utilized in a green field application thus significantly reducing greenhouse gas emissions associated with traditional fossil fuel power generation.

First Revenue Generation

First revenue generation is anticipated in the fourth quarter, and then the future plan is all about scaling up the modular technology to much larger Combined Cycle Power Plants.

WHAT NEXT? SCALING UP THE ENERGY TRANSITION

“The only practical solution for society to reduce carbon emissions is to transition from 100% fossil fuels to cleaner tech,” and one of the steps in tackling this is to blend hydrogen with fossil fuels and ramp up the hydrogen content whenever possible,” says Dave White, GH Power CEO and a veteran engineer in the power generation space. GH Power’s technology is modular and scalable which makes a plant’s configuration very flexible with maximum efficiency while meeting a customer’s energy requirements. GH Power has modeled a 27MW combined cycle plant and is in the early planning stages with customers.

Other companies looking to compete in the hydrogen race:

TotalEnergies (NYSE:TTE) is not the sort of company that half-commits to anything, and its hydrogen plans are no different. We're talking about a traditional oil and gas titan that's increasingly putting its chips on green energy—hydrogen being a key player. This isn't just some pilot project or a sideline venture; they're in it to become leaders in the hydrogen value chain.

Now, when a company with TotalEnergies' clout gets serious about something, you've got to take notice. They're applying their years of experience in the energy sector to this nascent industry, and it's pretty exciting. They're not just dipping their toes in the water—they're doing a full swan dive.

For investors, the upshot here is simple yet profound. TotalEnergies offers a balanced bet. They've got the traditional fossil fuel revenues to offer stability and a burgeoning green energy portfolio that promises growth. Hydrogen is a cornerstone of that portfolio, and the company's aggressive push into this sector could be a boon for shareholders.

Chevron (NYSE:CVX) seems to have taken the old adage "Go big or go home" quite seriously when it comes to hydrogen. This is a company that's looking at the whole hydrogen landscape—from fuel cell vehicles to power plants—and thinking, "We can do something big here." And considering their financial muscle, who's to say they can't?

What's different about Chevron's hydrogen endeavors is that they're not abandoning their old roots; they're leveraging them. It's a multi-layered approach, integrating hydrogen into their existing operations. That's both smart and economical, an evolutionary rather than revolutionary approach.

Investors, here's your cue. Chevron's in-depth involvement in hydrogen doesn't just offer a slice of the green pie; it promises a whole new bakery. They're using their financial clout and existing infrastructure to make a significant mark in this emerging field, and that could mean robust returns down the line.

ExxonMobil (NYSE:XOM) in hydrogen? Yep, you heard it right. They might be a latecomer, but they're no slouch. The plan here is meticulous, using their already sprawling infrastructure to tap into this growing market. It's a masterstroke that adds another layer to their energy portfolio without starting from scratch.

Sure, ExxonMobil isn't ditching oil and gas anytime soon. But here's the kicker: they don't have to. They're looking to be the smart integrators, the folks who can blend the old with the new seamlessly. If they pull it off, it's akin to having their cake and eating it too.

For those with their eye on long-term investment, ExxonMobil’s foray into hydrogen offers something tempting—a blend of the stability from traditional fuel sources and the growth potential of renewable energy. In an evolving energy market, that could be a sweet spot for many an investor.

Equinor ASA (NYSE:EQNR) play in hydrogen has a distinct character. Think of it as the Norwegians doing what they do best—leading by example in sustainability. Yes, we're looking at a company that aims to fully integrate hydrogen into Europe’s energy transition. They've got projects focused not just on hydrogen production, but also on carbon capture and storage.

You can think of Equinor as a puzzle master of sorts. Their talent lies in piecing together the many elements of the hydrogen economy into a coherent whole. And hey, they've got the Scandinavian flair for efficiency and sustainability.

For investors with an appetite for something a bit more international, Equinor presents a tempting option. This is a company that's got its hands in several cookie jars—from oil and gas to wind energy—and now it's diving deep into hydrogen. It’s a well-rounded play in an energy market that's becoming increasingly complex.

Eni SpA (NYSE:E) hydrogen story is intrinsically linked to Italy’s energy transition. From a company deeply rooted in the oil and gas industry, Eni is making audacious strides into hydrogen. Their recent partnerships aim to develop hydrogen production from renewable energy sources, and they’re already knee-deep in European projects aimed at creating hydrogen valleys.

The thing that sets Eni apart is their clear-cut focus on partnerships and collaboration. They're not going it alone; they're enlisting academic institutions, tech companies, and governments in their hydrogen endeavor. It’s a comprehensive ecosystem approach, which might just be their winning formula.

Now, why should an investor get hyped about Eni? Well, we’re talking about a company that’s making all the right moves to ensure it remains a key player in the future energy landscape. Their diversification into hydrogen is more than a fling—it's a long-term commitment that could yield solid returns.

Dow Inc. (NYSEOW) brings a unique lens to the hydrogen world. This isn't just about energy production for them; it's also about industrial applications. Dow is keen on using hydrogen as a raw material in its chemical manufacturing processes, which is a pretty smart way to kill two birds with one stone: reducing their carbon footprint and advancing hydrogen use.

Investors should take note of Dow’s multipronged approach. They’re not just consumers of hydrogen; they’re enablers. This dual role makes their involvement in the hydrogen economy distinct and impactful. They’ve got the muscle and the motivation to be influencers in this sector.

So, where does this leave an investor? With Dow, you're backing a company that's more than just a sideline spectator in the hydrogen game. They're a major player with skin in the game. As hydrogen becomes increasingly vital for both energy and industrial applications, Dow’s stock might just rise alongside.

Honeywell International Inc. (NYSE:HON) isn't just a spectator in the hydrogen game; it's an enabler. With a rich history in developing technologies for a range of industries, Honeywell sees hydrogen as a natural extension of its existing operations. We're talking about hydrogen production tech, storage solutions, and even safety systems tailored for hydrogen applications.

If you're thinking this sounds like a hydrogen one-stop-shop, you're not wrong. Honeywell is crafting an integrated approach that makes hydrogen adoption simpler and more efficient for everyone else. They’re the architects building the very framework upon which the hydrogen economy could stand.

For investors, Honeywell represents an investment in the backbone of the burgeoning hydrogen economy. It's a way to wager not just on one company, but on the success of hydrogen as a whole. Their cross-industry involvement provides a diversified hydrogen play that's worth paying attention to.

NextEra Energy, Inc. (NYSE:NEE) is big on wind and solar, but let's not overlook their hydrogen agenda. They’ve recently initiated pilot projects to produce hydrogen from solar power, a method that's as green as it gets. This is the firm betting that hydrogen will be the perfect companion to renewable energy sources, providing storage and versatility.

It's like they've put their ear to the ground, heard the rumblings of the green hydrogen revolution, and decided they need a piece of that action. Their pilot projects may be small-scale now, but the implications could be massive. They're not just dabbling in hydrogen; they're connecting the dots between different renewable sources.

If you're an investor looking for a diversified renewable energy portfolio, NextEra is where the action is. They’re already a powerhouse in renewables, and their hydrogen projects could add another layer of growth potential. It’s the sort of multi-layered bet that might just pay off big.

Dominion Energy Inc. (NYSE) is carving out a niche for itself in the hydrogen economy by focusing on clean hydrogen solutions. They're taking their utility expertise and applying it to the production, storage, and distribution of hydrogen—creating an integrated, end-to-end offering that's not easy to come by.

Here's the kicker: Dominion isn’t just looking at hydrogen as an add-on; they're eyeing it as a critical piece in a broader clean energy strategy. They've got projects focused on using excess renewable energy to produce hydrogen, creating a synergistic relationship between two of the hottest sectors in clean energy.

So, why should this matter to an investor? Dominion is a prime example of an established utility company leaning into the future. By embracing hydrogen, Dominion is positioning itself as a leader in what could become one of the most transformative shifts in the energy landscape. It's like betting on a seasoned athlete who has found a second wind.

PG&E Corporation (NYSECG) has had its share of challenges, but don't overlook their foray into hydrogen. They've been working on integrating hydrogen into California's renewable energy scene, which is no small feat. The company is exploring projects to harness wind and solar power for hydrogen production, effectively knitting together a sustainable energy tapestry that's hard to rival.

What's intriguing about PG&E is how they're leveraging their existing infrastructure. The company is investigating the potential for hydrogen blending in natural gas pipelines, which could be a game-changer. It's like they're playing 3D chess while the rest of us are still figuring out checkers.

From an investment perspective, PG&E’s involvement in hydrogen is noteworthy. This is a company that's looking to redefine itself and emerge stronger from its past setbacks. Their hydrogen initiatives provide a glimpse into a more resilient and diversified future, potentially offering investors an opportunity for both redemption and growth.

By. James Stafford

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that the governments are funding development of hydrogen technologies; that significant funds are being invested in clean hydrogen producers; that governments are aiming to help develop carbon-free clean hydrogen solutions; that hydrogen power will be utilized as a main driver for decarbonization and as a source of energy for the global economy in the future. replacing fossil fuels and other competing alternative technologies in the future; that GH Power Inc.’s technology will be developed, commercially implemented and achieve widespread market acceptance; that GH Power will complete the development of its hydrogen reactor that will produce hydrogen 60% cheaper than by electrolysis, become a net producer of energy to the supply grid, co-produce alumina which is 85% cheaper than current production methods; that GH Power’s technology will be revolutionary in the decarbonization of the energy sector; that GH Power’s small pilot model will be scalable at the commercial level in the proposed reactor in Hamilton, Ontario, and will achieve the anticipated results of clean, carbon-free energy production and related bi-products; that GH Power can finance ongoing operations and development; that GH Power can achieve its business plans and objectives as anticipated. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition including that governments may fund the development of alternative technologies instead of hydrogen based technologies; that hydrogen technology may fail to gain widespread commercial use and acceptance due to safety, cost or other issues; that alternative technologies may be preferred in the future to hydrogen technologies as the main replacement of fossil fuels and other energy sources; that GH Power Inc.’s technology may fail to be completely or successfully developed and/or commercially implemented; that alternative technologies may gain wider acceptance than or prove to be superior to those of GH Power for various reasons; that alternative technologies may result in greater energy savings and necessary bi-products; that GH Power’s technology may fail to deliver the results anticipated in a commercial setting; that GH Power’s commercial reactor may not be developed as anticipated or at all; that GH Power may be unable to finance its ongoing operations and development; that the business of GH Power may be unsuccessful or otherwise fail for various reasons. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated by GH Power Inc. for this article but may in the future be compensated to conduct investor awareness advertising and marketing for GH Power Inc. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct. The content of this article is based solely on our opinions which are based on very limited analysis and we are not professional analysts or advisors.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of GH Power Inc. and therefore has an incentive to see the featured company perform well if its securities becomes listed on a stock exchange. If the securities of GH Power become listed on a stock exchange, the owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of GH Power Inc. in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we are biased in our views and opinions in this article and why we stress that you should conduct your own extensive due diligence and research regarding the Company as well as seek the advice of your qualified professional financial advisor or a registered broker-dealer before you consider investing in any securities of the company profiled in this article or otherwise.

NOT AN INVESTMENT ADVISOR. Oilprice.com is not qualified, registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendations.

ALWAYS DO YOUR OWN RESEARCH and consult with a qualified and licensed investment professional before making any investment. This communication should not be used as a basis for making any investment in any securities.

RISK OF INVESTING. Investing is inherently very risky. Don't invest or trade with money you can't afford to lose. This is neither a solicitation nor an offer to invest in or buy/sell securities. No representation is being made that any stock investment, acquisition or disposition will or is ever likely to achieve profits.

Last edited: